Morocco’s comprehensive pension system reform may face postponement beyond the 2026 legislative elections,as government officials acknowledge the complexity of achieving social consensus on the politically sensitive restructuring. In an interview with le360 news outlet,Economist Zakaria Ferano argues that “an electoral year is inappropriate for this type of undertaking,” given the technical,social,and political challenges surrounding pension reform implementation.

Prime Minister Aziz Akhannouch recently suggested potential delays,emphasizing the necessity of establishing “consensus vision” between public authorities and labor unions regarding reform objectives,methodologies,and scope. Finance Minister Nadia Fettah will convene a new meeting of the national commission overseeing the dossier,including social partners in upcoming discussions.

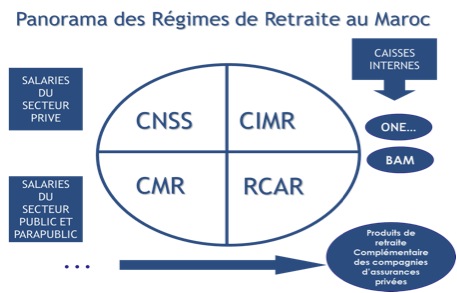

Morocco’s current pension landscape reveals stark inequalities requiring urgent attention. The National Social Security Fund (CNSS) provides average pensions of only 2,300 dirhams,while the Civil Service Pension Fund (CMR) delivers 8,000 dirhams monthly and the Collective Retirement Allowance Scheme (RCAR) exceeds 10,000 dirhams. These disparities highlight fundamental equity concerns driving reform necessity.

Critical reform questions remain unresolved: maintaining the current pay-as-you-go system versus transitioning to funded pensions,expanding points-based schemes,and potentially raising legal retirement age. Ferano emphasizes that “equity and equality principles between different schemes” must guide any systematic changes.

The economist warns against implementing major reforms during government mandate’s final year,describing such timing as “unimaginable,even improbable.” Electoral periods complicate union negotiations,while incomplete debates risk exacerbating social tensions rather than resolving underlying structural problems.

Current political dynamics suggest achieving labor union agreements during election campaigns remains highly unlikely. The government appears committed to building solid national consensus before advancing inevitable but complex pension restructuring,logically extending implementation timelines beyond 2026.

United News - unews.co.za